Demystifying equity release

Despite increasing popularity, equity release remains misunderstood. Jim Boyd, CEO of the Equity Release Council defines it simply: a way to unlock the value of your home, typically via a lifetime mortgage, without needing to sell or make monthly repayments.

“One of the biggest myths is that you’ll lose your home—this is simply not true. Our standards guarantee security of tenure and flexible repayment options.” – Jim Boyd, CEO, Equity Release Council

The Equity Release Council has introduced safeguards like portability, inheritance protection, and the well-known “no negative equity guarantee” to build trust and protect consumers. These measures are helping the industry shed its legacy reputation.

Consumer attitudes are shifting

Recent research from the Council found that over 61% of homeowners would now consider using their property wealth to support retirement—up from 57% just a few years ago. That’s around 19 million people. Notably, younger homeowners are leading this shift, viewing property more as a financial asset than something to be preserved for inheritance.

“The generation entering retirement today has different expectations. Equity release is no longer a last resort—it’s part of a broader toolkit for financial planning.” – Jim Boyd, CEO, Equity Release Council

Market growth, barriers, and opportunity

With over £2.5 trillion in housing wealth held by over-65s in the UK, the potential for equity release is huge. Yet, uptake remains limited. What’s holding it back?

- Historical mistrust due to outdated products and poor advice.

- Low awareness of how the market has evolved.

- Cultural barriers, particularly among older generations focused on leaving an inheritance.

That’s changing. Regulatory pressure (like Consumer Duty) is requiring advisers to take a more holistic view of a client’s assets—including property. This presents an opportunity for innovation and more comprehensive advice.

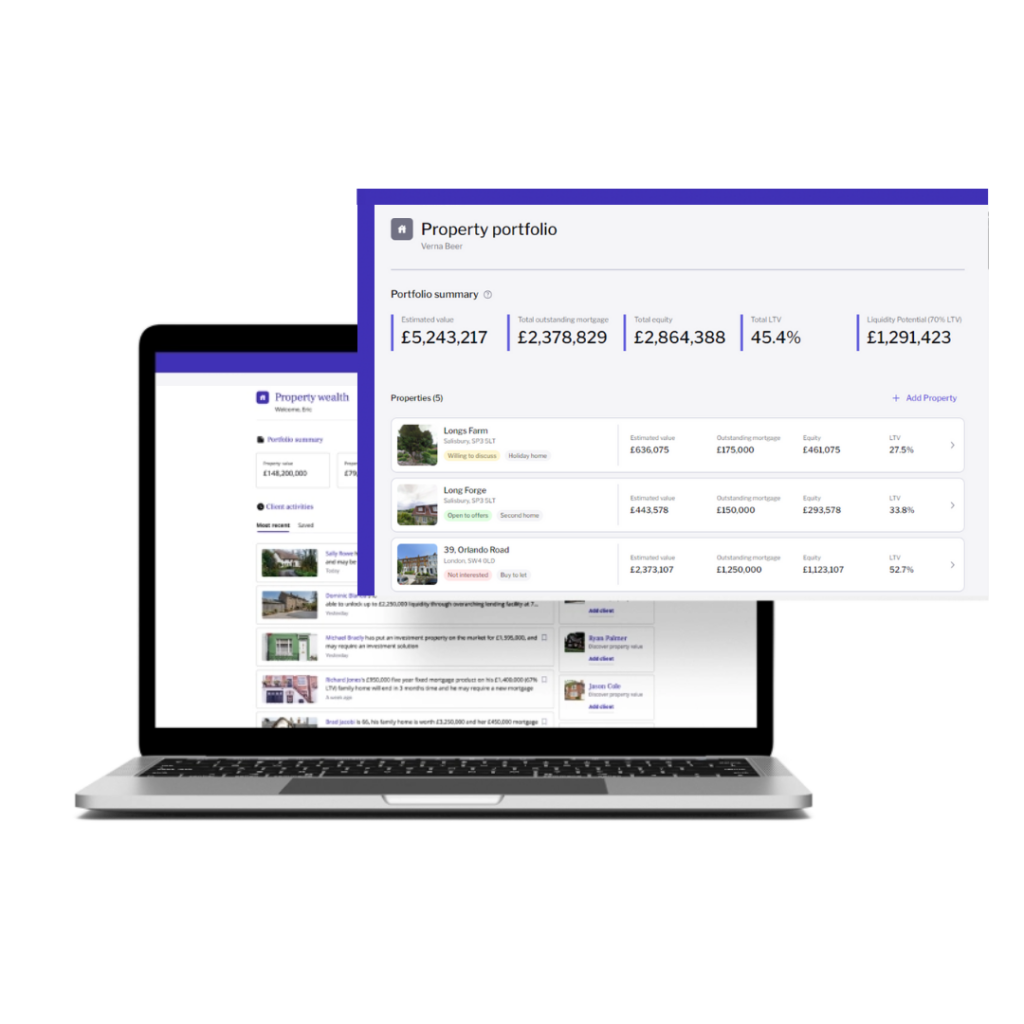

Technology as a catalyst for change

Jim stresses the need for better digital tools to help both consumers and advisers understand their options. From interactive illustrations to integrated calculators, platforms like Nokkel can play a key role in making later life lending more accessible and transparent.

“Technology is crucial to improving financial literacy and making advice more inclusive.” – Jim Boyd, CEO, Equity Release Council

At Nokkel, we believe that accessing accurate, real-time property data is foundational. Whether you’re planning to age in place, help children with a deposit, or boost your retirement income, better tools mean better outcomes.

International lessons and global leadership

The UK is currently recognised as a global leader in later life lending. According to Jim, countries like Australia and Canada are actively learning from the UK’s regulatory model and consumer safeguards.

“Solving the retirement income gap is a global issue. Our job at the Council is to continue leading by example—and collaborating with international partners.” – Jim Boyd, CEO, Equity Release Council

What comes next?

The Equity Release Council is focused on:

- Enhancing consumer understanding through education.

- Creating a clearer framework for when and how property options should be discussed in advice.

- Promoting innovation that helps advisers embed property into retirement conversations.

At Nokkel, we’re proud to be part of that mission—supporting advisers with tools and data that bring property wealth into holistic planning.

For more insights, visit nokkel.com and follow us on LinkedIn.