In the world of financial planning, technology isn’t just improving efficiency—it’s transforming the client experience. But is it going far enough?

In a recent episode of Nokkel Talks, Nokkel CEO Roland Whyte sat down with Alan Moran, founder of Interface Financial Planning and author of How Financial Planning Can Transform Your Life. As an early adopter of technology and a passionate educator, Alan shares how digital tools have reshaped his work and why property needs to play a bigger role in advice.

From paperless pioneer to tech-driven planner

Alan began his career as a teacher before becoming one of the UK’s first qualified financial advisers. Since the 1990s, he’s been a vocal advocate for technology in financial services—from going paperless in 2006 to launching open banking tools that give clients real-time insight into their income, expenses, and forecasts.

This shift, he says, has completely changed the adviser-client relationship.

“It’s taken us beyond the drudgery of facts and figures,” Alan explains. “Now we focus on values, goals, and what truly matters.”

Property as the missing piece in holistic wealth

Despite advances in digital advice, Alan argues that property remains the most underrepresented component of wealth in financial planning.

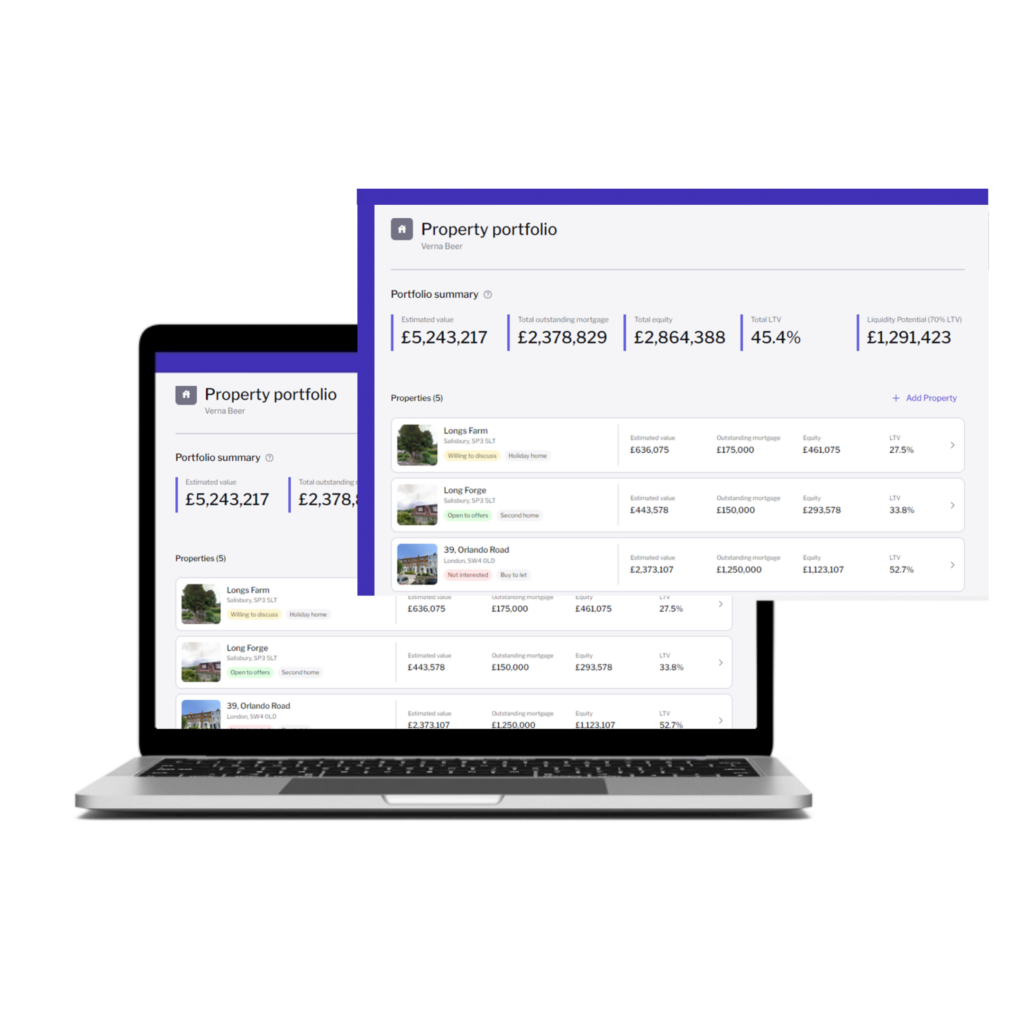

Whether it’s helping a client downsize in retirement, manage a portfolio of buy-to-let properties, or release equity for care, property decisions are central to the advice journey. Yet advisers often lack the tools to manage this data with the same ease as investments.

A client asked me this morning, ‘How much will I get for my house?’ and I had no quick way of telling her, Alan shares. “If I had property data at my fingertips, I could focus on the advice instead of chasing paperwork.”

He stresses that real-life decisions—like going into care or helping children onto the property ladder—need seamless, integrated solutions.

Equity release and later life lending: from pain point to possibility

Later life lending is one of the most sensitive but impactful conversations an adviser can have. As Alan points out, it’s not about pushing products, but giving clients options based on their goals.

Take the example of a recently divorced client who wanted to access the equity in her home to fund travel during retirement. Alan was able to advise her, but the process remained manual and inefficient.

“Equity release has a complicated past, but the future should be about access to information,” he says. “If tech can simplify this, it becomes a helpful conversation—not a hard one.”

Why financial planning must evolve

Alan is clear on one thing: the industry needs to focus more on total wealth, not just liquid assets. Too many advisers still define clients by their “investable assets,” leaving out major wealth drivers like property.

“Holistic financial planning is about value, not just percentages,” he says. “If I can’t manage your property data, how can I offer truly comprehensive advice?”

He sees tools like Nokkel as essential to bridging that gap—especially in a future where advisers must be more efficient to serve a broader range of clients.

Intergenerational wealth and lifecycle advice

Property is also central to intergenerational wealth transfer. From structuring assets to mitigate inheritance tax to helping adult children onto the housing ladder, Alan believes this should be part of every annual review.

He also highlights the technical considerations around property ownership, trusts, capital gains, and long-term care. Without structured data and automated tools, these issues can easily fall through the cracks.

“Property touches every stage of life. It’s not a niche—it’s a necessity,” says Alan.

Closing the advice gap

At Nokkel, we believe that access to accurate, real-time property data can help advisers make better decisions, faster—while supporting their clients through some of life’s most important transitions.

Alan’s real-world insights reinforce our mission: to make property wealth visible, usable, and integrated into holistic advice.

“Nokkel fills a critical gap in financial planning,” Alan concludes. “It helps me serve clients the way they deserve to be served.”

For more insights, visit nokkel.com and follow us on LinkedIn.